Canadian sales of legal cannabis pre-rolls nearly doubled between 2020 and 2021, outstripping total marijuana market growth as convenience-seeking consumers increased spending on the ready-to-smoke form factor, according to data from Seattle-based cannabis analytics company Headset.

Consumers have established clear preferences for the second-largest category in Canada’s cannabis market after dry flower.

Key pre-roll trends include:

- A consumer shift toward larger multipacks mirrors a trend in U.S. cannabis markets.

- Price competition to win value-conscious consumers.

- Increasing popularity of concentrate-infused pre-rolls, which combine a joint with a cannabis concentrate for a more potent experience.

“The infused pre-rolls are popping off right now, for sure. … We’re selling quite a few of them on a regular basis,” said Ryan Roch, owner and operator of Alberta independent retailer Lake City Cannabis, with locations in Calgary and Chestermere.

When it comes to meeting pre-roll consumers’ expectations, Canadian cannabis industry insiders recommend:

- Focusing on convenience and value, which are core desires for pre-roll users.

- Ensuring a consistent pre-roll experience across different production runs.

- Prioritizing quality over rushing to market.

Category growth ignites

There’s no question that Canadian cannabis consumers are willing to spend on pre-rolls.

“Pre-rolls, in both the U.S. and Canada, have been doing really well over the last year or so,” said Cooper Ashley, Headset’s senior data analyst.

“In both markets, right at the beginning of COVID, pre-roll market share dropped pretty significantly” as the pandemic discouraged in-person socialization and sharing, Ashley added.

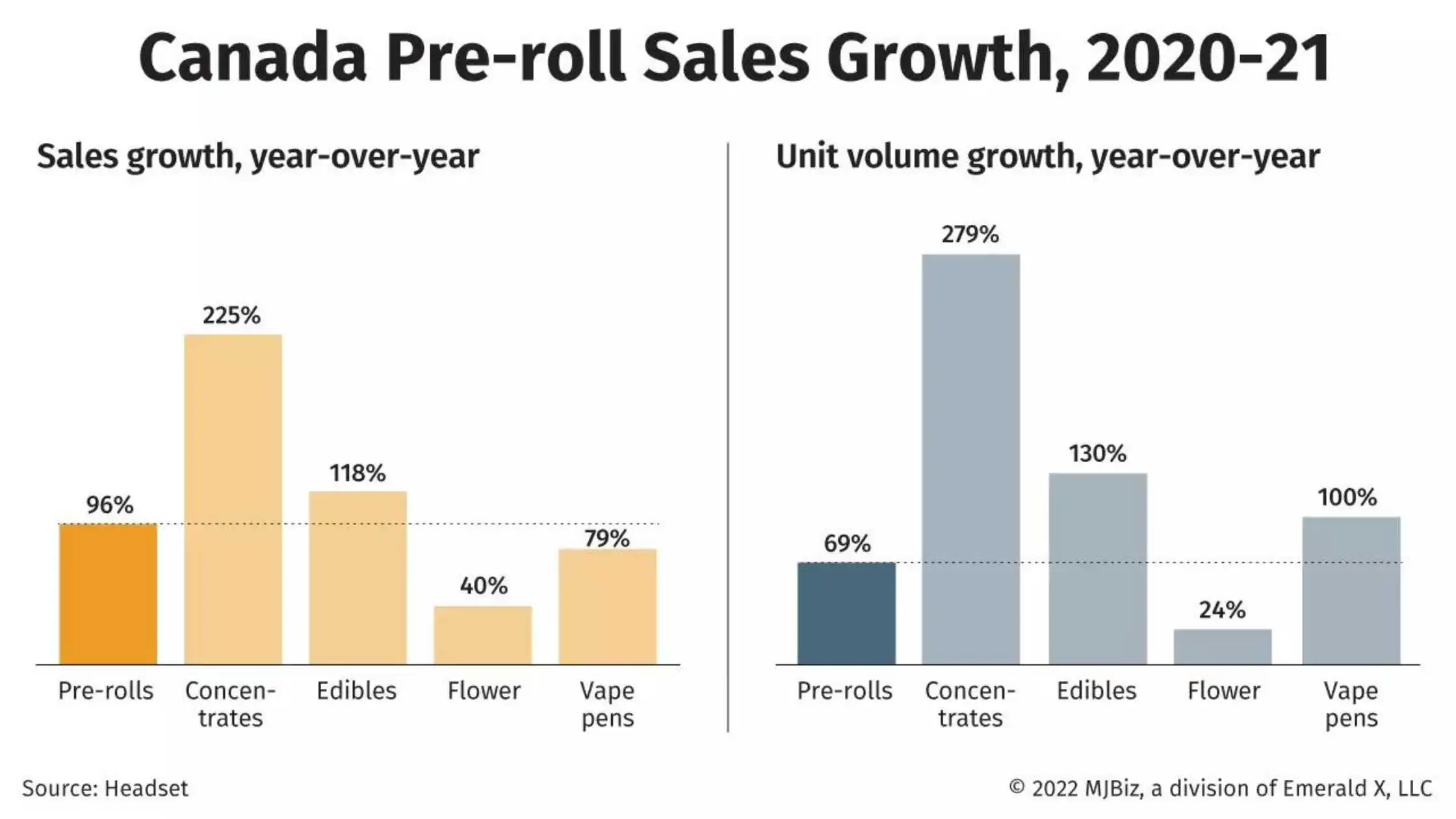

However, pre-roll sales increased by 96% between 2020 and 2021 to 589.7 million Canadian dollars (roughly $460 million), outpacing total market growth of 61% in the four Canadian adult-use markets Headset tracks: Alberta, British Columbia, Ontario, and Saskatchewan.

(Those four provincial markets comprised roughly 78% of Canadian recreational marijuana sales in February.)

By unit volume, pre-roll sales grew by 69%, to 33.3 million units, in the Canadian markets tracked by Headset from 2020 to 2021.

Headset pricing data indicates a shift toward larger multipacks, with average item price increasing as average price-per-gram fell throughout 2021.

Pre-roll market share in Headset’s markets rose from 16.7% of sales in 2020 to 20.3% of sales in 2021.

That momentum appears to be continuing: Year-to-date, pre-roll sales have earned roughly 22.5% market share, showing a continued rebound from the early lows of the COVID-19 pandemic.

“If you’d asked me back in 2020 if we would see this type of growth in pre-rolls, I would have said no,” Alberta retailer Roch said.

“I think the pandemic probably played a bit of a part,” he said.

“We saw a lot of people come out and experiment where they maybe wouldn’t have before.”

Pre-roll preferences

Redees, multipacks of small, cigarette-style joints from Hexo Corp.’s Redecan subsidiary, remain the leading Canadian pre-roll brand, with year-to-date sales of roughly CA$24.9 million and market share of 10.7% in the four provinces Headset tracks.

(Redees are so popular that Hexo sells “king packs” containing 70 pre-rolls of 0.4 grams.)

Ontario producer Weed Me holds the No. 2 spot in pre-rolls with year-to-date sales exceeding CA$13 million for a 5.6% market share.

Pre-rolls from British Columbia producer Pure Sunfarms sit in third place, with CA$12.2 million in year-to-date sales and a 5.2% market share.

Pure Sunfarms offers three packs of 0.5-gram pre-rolls, 10 packs of 0.3-gram joints, and 14 packs of 0.5-gram pre-rolls.

“At the end of the day, consumers inside and outside of cannabis want products that are ready to consume, and pre-rolls hit that format,” Pure Sunfarms CEO Mandesh Dosanjh said.

Dosanjh said the company grew its pre-roll market share by taking the grower’s “really recognized (whole-flower cannabis) strains and continuing to make sure they’re available in the pre-roll format for the consumers to be ready to consume.”

Operationally, Dosanjh said Pure Sunfarms has invested in technology and automation “so we can increase production, improve our economics and give really good value to the consumer.”

Dosanjh said pre-roll consumers are particularly interested in a “consistent, repeatable experience.”

Producers looking to boost their pre-roll performance should focus on consistency and quality, he advised.

“The pre-roll consumer, if they have a bad experience in trying that pre-roll, you can lose that consumer forever,” he said.

“I’d say doing things the right way, making sure you can stand behind the product you’re putting in the packaging and not rushing, is going to be key to moving the industry forward.”

Retailer Roch advised producers to focus on “convenience and price” in the pre-roll market to fulfill consumer desires.

“When you meet those two (criteria) on pre-rolls, they tend to move at better velocities,” he said.

As for retailers, Roch recommended carrying a wide selection of pre-rolls.

“Having that big pre-roll list and offering your consumers choice is definitely exciting for them.”

Future pre-roll trends

Pre-rolls have sold 12.8 million units year-to-date in Headset’s Canadian markets, totaling more than CA$233 million.

Dosanjh anticipates continued category growth for pre-rolls.

He also has his eye on infused pre-rolls that combine a joint and cannabis concentrate.

Pure Sunfarms plans to release infused pre-rolls this year, Dosanjh said.

Retailer Roch has some concerns about the consumer experience for infused pre-rolls.

“When you start to smoke them, they generally don’t burn great – usually the last quarter of it is all gummed up. … We start to see people get a little frustrated,” he explained.

Infused pre-rolls are also “a bit expensive,” Roch added.

Plus, they can’t be sold in bulk formats because Canadian cannabis weight-equivalency rules treat infused pre-rolls as concentrates, rather than dry flowers, limiting how many can be bought at once.

Roch believes that blunts, another pre-roll segment, could be “a bigger market that’s potentially unexplored.”

“We’ve had blunts come in and out – they have not been in any level of adequate supply to give us good supply and demand on that,” he added.

“But they’re stupid popular. People love them.”

Disclaimer: https://mjbizdaily.com/canadian-pre-rolls-still-no-2-cannabis-category-outpaces-total-market-sales-growth